Cross-Border Insolvency – Global vs Local

Cross-Border Insolvency Industry AnalysisThe world is a global marketplace, held together by mutual commercial relationships, mutual laws and mutual trade practices.

Nowadays the demise of one company can have a dramatic, news-breaking, effect on companies and consumers around the world. The collapse of Hanjin Shipping in 2016 not only put into doubt whether consumers would receive their Samsung TVs for Christmas, but also asked serious questions about how an orderly liquidation or rehabilitation could be conducted if major assets (the ships) were spread across the world and subject to a diverse range of domestic insolvency regimes.

This situation highlighted THREE areas of uncertainty – choice of law, choice of jurisdiction and enforcement of rulings. There are two competing extremes of cross-border insolvency resolution – commonly called the Universal Approach and the Territorial Approach.

Universal Approach – handling of all claims and assets would be resolved in the debtor’s country, under the laws of that jurisdiction and that all courts would act under commonly agreed international laws.

This remains an aspiration of course, waiting for the time when the world operates under one system of laws. The leading attempt is seen in relation to the United Nation’s UNCITRAL Model Law, dating from 1997. Thus far over 45 jurisdictions have signed up, including the USA, UK, South Korea, Japan and South Africa. No China at present. The members of the European Union have a similar agreement, the EC Regulation on Insolvency Proceedings 2000.

Alternatively, the Territorial Approach would see courts in each jurisdiction seize and distribute assets that happened to be under their control, in accordance with local laws. There is an obvious upside for local creditors in this scenario and assets could be liquidated very quickly – but at what cost to other creditors?

So, one extreme doesn’t truly exist and the other provides satisfaction to only a few lucky parties. Hence there is a movement to meet in the middle, with Modified Universalism and Cooperative Territorialism, also known as Hybrid Approaches. Of the two, Modified Universalism is making the most headway. This was the system adopted in the case of Hanjin Shipping and proved the practicality of the system.

In the Hanjin instance individual countries were requested to agree (with South Korea) that the best place to conduct proceedings would be in Seoul. Jurisdictions where assets happened to be located deferred to the South Koreans, whilst retaining the discretion of local courts to protect local creditors’ rights. These rights extend to the point of negotiating special treatment before releasing locally seized assets to the main proceedings, by making sure that in so doing this did not conflict with their country’s public policy.

Going forward, the Modified Universal Approach is the one that is being increasingly adopted. Its overall transaction costs are certainly lower than the Territorial argument.

Bankruptcy, insolvency, liquidation, Chapter 11 – SAME SAME?

Bankruptcy Industry AnalysisLSR is often sent emails from clients expressing their concern or frustration about a customer that has gone into receivership / liquidation / bankruptcy / insolvency / Chapter 11 / administration or simply “gone bust”.

Each of these words or phrases has a different meaning and confusion may result in unwanted consequences, such as claims being unregistered or money and time being wasted.

The list below has been compiled to show the subtle, and not-so subtle, differences in terminology (Note: There is no overall law or jurisdiction in mind within the terminology below).

Insolvency: In simple terms, when a company cannot pay debts or service obligations as they fall due because liabilities exceed assets. However, this can be defined more specifically into Cash-Flow insolvency and Balance Sheet insolvency.

Cash-Flow Insolvency: When a company has sufficient assets to cover its obligations, but cannot service the debt as the assets are in the wrong form. For example, a company may own land and buildings, but does not have sufficient cash to pay for raw materials bought on 30 days credit. Cash-flow insolvency can usually be resolved by negotiation, patience or the raising of working capital finance.

Balance Sheet Insolvency: When there are insufficient assets to pay all the debts. A company may still have enough cash to pay bills as they fall due but it would be running the risk of establishing an illegitimate preferred creditor if it did i.e. ranking one creditor above others or the Directors leaving themselves open to accusations of wrongful trading.

Winding Up Petition: Used by a creditor when a debtor continuously refuses to pay its uncontested debts. The creditor presents its petition to the court to have the company closed down. If it’s successful then a winding up order is made by the Court.

Liquidation: This is when the company has been officially declared “dead”, never to be resuscitated. A liquidator is placed in charge by the court that has jurisdiction and it is their sole job to dispose of all assets and distribute the proceeds to creditors (the remainder going to the shareholders).

Court protection: A very broad expression implying that a company is operating under a moratorium provided by a court that has jurisdiction in the matter. The moratorium protects the company from creditors taking legal action against it for recovery of debts.

Chapter 11 – This is specific reference to Chapter 11 of Title 11 of the 54 titles that make up the Code of Laws of the United States. Title 11 of the code addresses bankruptcy and Chapter 11 of that title addresses re-organisation. Chapter 7 covers liquidation. Chapter 11 retains many of the features present in bankruptcy proceedings in the U.S.A. Most importantly it empowers the trustee to operate the debtor’s business. In most instances the debtor in possession (the company itself – and its current management) acts as trustee of the business. The debtor in possession has a number of mechanisms to restructure its business such as obtaining finance on favorable terms by giving new lenders first priority on the business’s earnings. The court may also allow the rejection and cancellation of contracts.

“Singapore Chapter 11” – recent changes in Singaporean law have refined the restructuring facilities available there and brought the country’s legislation more in line with that of the USA’s Chapter 11.

Administration: More often used in the context of English law. A company may enter administration because it is in financial difficulties. An administrator is appointed to manage the company to see whether the company can continue in some form or be sold.

Receivership: Should a company default on a secured debt, the debt holder can call on a receiver to go into the company to sell the company’s assets in order to pay back some or all of the debt. This is a harsh remedy with typically little chance of the company surviving, as management will lose control of the business while the receiver sells the assets with the sole purpose of reimbursing the secured creditor.

Fraudulent trading: This is the continuation of trading despite there being no reasonable prospect of repaying debts and with the intent to defraud creditors. Examples of fraudulent trading include selling off assets at less than market value and accepting payment in advance in full knowledge that the order would not be fulfilled. Historically, fraudulent trading has been difficult to prove but generally it does carry the risk of a prison sentence, disqualification and financial penalties for Directors

Wrongful trading: The (usually) well-intentioned little brother of fraudulent trading. This is a common enough scenario where Directors want to trade through a known difficult situation or ignore the reality of their situation. However, Directors have an obligation to shareholders and creditors to limit their exposure once insolvency is upon them.

Financial Difficulties

Company News Industry AnalysisLSR often become involved when companies are facing financial difficulties. For examples:

- struggling and getting behind on its payments- suppliers need information about the target in order to better manage the debt and mitigate losses;

- liquidation- liquidators seek our assistance in analysing an insolvent company’s debtor’s ledger so that more effective collection strategies can be put in place;

- enforcement- creditors aiming to identify assets of debtors that are reneging on their responsibilities and to support enforcement activities.

- and more…

We will be providing a series of posts over the coming weeks on various aspects of insolvency including:

Bankruptcy, insolvency, liquidation, Chapter 11 – SAME SAME?

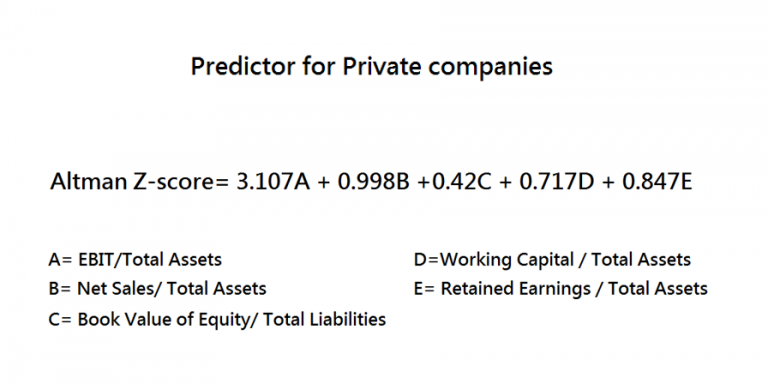

How to spot a company close to insolvency?

Cross-border Insolvency – Diversity and attempts to synchronise!

Another Chapter 11 Regime – Singapore?

Registered Capital of a Chinese company – all things to all men?

China Industry AnalysisRegistered Capital is an integral part of establishing a company and subsequent filings in China, whether its domestically owned or whether it’s a Wholly Foreign Owned Entity (WFOE). Each company has to disclose it on its Business License, a proof of company existence and the ability to trade legally.

So…“Registered Capital” is often the foremost tangible, and some would say, reliable financial figure that is available to third parties in their due-diligence.

But what does Registered Capital actually mean? There are numerous expressions explaining capital:

Authorised Capital – maximum amount of the capital for which shares can be issued by the company to shareholders.

Issued capital – share capital that has been issued to shareholders.

Paid Up Capital – the amount of money a company has received from shareholders in exchange for shares, at par value.

In China, the Registered Capital is akin to Issued Capital. However, the country currently implements a subscription registration system and a company’s Shareholders are not required to pay up the full capital provisions before they obtain their Business License.

In terms of complying with domestic law, so long as the shareholders pay over the capital funds (can be currency, fixed assets, intellectual property, land use rights, copyrights, trademark rights etc) within the time specified in the Company’s Articles of Association as agreed and decided by the shareholders/sponsors, then the company is in full compliance. However, our correspondents in China advise that it generally means 10-20 years, even up-to 50 years can elapse before the capital is actually paid in.

To outsiders undertaking due-diligence, with little information to rely on about the financial resources of a company, this understanding of what is being analysed is crucial. Bottom line – just because a company has an impressive registered capital it doesn’t mean it’s adequately capitalized.