Restructuring Land Grab?

Industry Analysis RestructuringSingapore aims to be Asia’s restructuring hub. The commercial world is now seeing the plan unfolding.

LSR recently assisted a client who was baffled about a debtor who had “gone into CHAPTER 11 in SINGAPORE”, a scheme outside the USA you might be unaware of.

Although this issue was discussed widely in legal circles, it’s only with the passage of time that its effect is seen within the commercial world, as companies’ counterparts fail and creditors seek to recover debts.

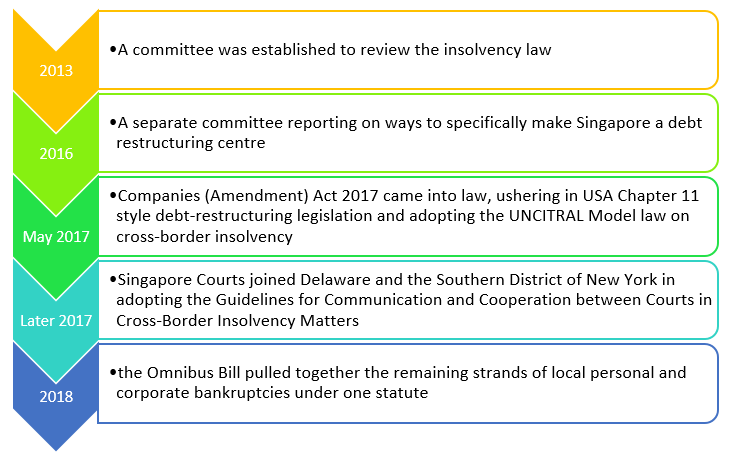

Following on from last week’s post about Cross-Border Insolvency, we briefly outline Singapore’s bold move to establish itself as the debt-restructuring hub of Asia.

Within 6 months of the new laws being enacted in 2017 there had already been some significant cases brought within its jurisdiction. These included Bakrieland Development Attilan Group, TT International, Emas Offshore and Nam Cheong. More recent cases have included the current high profile Hyflux case, whose initial“automatic”30 day moratorium was made in May 2018. More time was granted until November 2018 and then again until April 2019, despite objections from some creditors concerned about transparency.

So, what are the MAIN points about Singapore’s restructuring environment? Please refer to the “Companies (Amendment) Bill 2017” and “FACT SHEET ON THE COMPANIES (AMENDMENT) BILL 2017 AND LIMITED LIABILITY PARTNERSHIPS (AMENDMENT) BILL 2017”.

Overall, the recent changes in Singapore have been well received. It is still in its infancy and “the law in practice” will develop over time, being tested by applications from one party or another seeking an advantage. However, there is no denying that Singapore has stolen a march on its rivals in the region, invested in support infrastructure and sucked in legal expertise to capitalise on this new centre of opportunity.